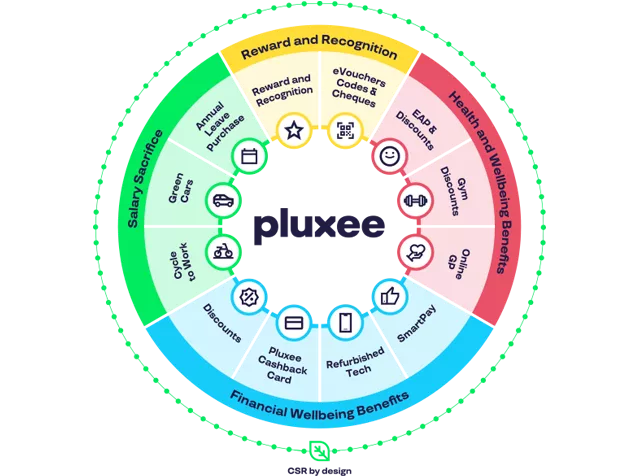

Financial wellbeing platform & benefits

Empower your people with a financial wellbeing platform that seamlessly connects to the wider Pluxee employee benefits experience. From exclusive discounts with 500 top retail partners to SmartPay payroll-linked payments, eVouchers, recognition tools and physical wellbeing support—Pluxee brings every benefit together in one easy-to-use platform. Help your workforce feel more supported, more rewarded and more in control, every day.