Salary Sacrifice Schemes

Bolt our salary sacrifice and salary deduct schemes onto our Employee Benefits Platform for free!

Save your business and employees money and enhance employee wellbeing.

With a Salary Sacrifice Scheme, employers recoup the monthly repayment from employees’ gross earnings, lowering their tax and NIC contributions. Cycle to Work and Green Car schemes also reduce the employer's National Insurance Contributions, reducing business outgoings.

With Salary Deduction Schemes, you recoup the monthly repayment from the net salary after calculating tax and NIC. Salary deduct schemes are cost-neutral, as employees repay their employer over a period of time. They do not offer additional savings but are an interest and debt-free alternative to loans and credit cards.

Our Salary Sacrifice Schemes are free-to-implement* employee benefits that deliver business and employee savings. Help employees afford a new bike, EV car and extra holiday by spreading the cost over monthly salary deductions.

With the pending increase in employer National Insurance Contributions (NIC), salary sacrifice is essential to your business savings strategy, reducing your payroll bill and freeing up funds to invest elsewhere. Using benefits savings to fund growth… it’s the Pluxee Effect!

*Terms and conditions apply. Please speak to a member of our team for more information.

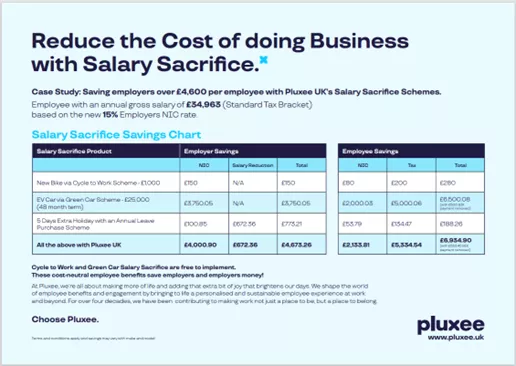

If an employee on a salary of £34,963 took out a £1,000 Cycle to Work Scheme, a £25,000 Green Car scheme (over 48 months) and purchased five extra days of annual leave, your business could save £4,673.26.

If thirty employees did the same, that saving increases to £140,197.80 potential employer savings.

Did you know that if just four employees on a salary of £34,963 took out a £25,000 Green Car scheme, it could cover the cost of our Employee Discounts Platform, Employee Assistance Programme, Online GP, and discounted Gym Membership benefits?

Salary sacrifice for employees also delivers considerable savings as their tax and National Insurance Contributions reduce for the duration of the scheme. An employee on a £25,000 Green Car scheme could save up to and over £6,500 in total!

Who doesn’t love that new car feeling?

When you make an EV car attainable and affordable for your employees through salary sacrifice, enhancing their emotional and financial wellbeing, it boosts their loyalty to your business and increases employee engagement.

Access your Salary Sacrifice Schemes from our all-in-one Employee Benefits Platform. We fully manage our HMRC-approved schemes with minimum extra workload for you but guaranteed compliance.

Our in-house team provide marketing and communications support, driving employee engagement and scheme uptake. More savings for your people and business!

With no up-front employer fees or risk, our fully managed Green Car scheme makes an EV car affordable and brings employee and employer savings.

Employees get a new bike and a cheaper commute with this fully managed scheme that enhances financial and physical wellbeing while delivering employer and employee savings.

A wellbeing-boosting, admin-light solution that enhances work-life balance and reduces your business's payroll bill.

A cost-neutral tech and lifestyle salary deduct scheme that helps employees afford the things they need without falling into debt.

An eco-friendly employee benefit that makes top tech more affordable, where employees can pay up-front, via salary deduct or under a salary sacrifice scheme.

Each scheme operates differently, but the common theme across all is that as an employer, you get to set the terms of your scheme.

Employers deduct salary sacrifice scheme repayments at the gross level (before tax and NIC), reducing your taxable income and tax and NIC payments. Employers recoup salary deduction schemes at the net level after tax and NIC payments have already been removed, so there are no additional savings for the employer or employee. There's also less admin for HR with salary deduct.

The terms differ per scheme. With Cycle to Work, the employer would take any outstanding repayment from the final salary payment, and Scheme Protect is available to alleviate employer risk. With Green Cars, the agreement is between the employee and the leasing company, who can assess the available options.

If you already use our Employee Discounts Platform, speak to your Account Manager about bolting on our salary sacrifice schemes for free. For new enquiries, complete our contact form and request a call.

In lieu of a calculator (which we can build) we have this chart. Green Car calculators are highly complex. We have calculators we can replicate on our customer sites for C2W and SmartPay.

We fully manage our schemes to ensure they’re HMRC-compliant and inclusive to all employees. However, we cannot offer the scheme to employees if the repayments reduce their salary to below the minimum wage.

Book a Demo to see how we can make a difference together!