How do I get started with Pluxee’s salary sacrifice schemes?

If you already use our Employee Discounts Platform, speak to your Account Manager about bolting on our salary sacrifice schemes for free. For new enquiries, complete our contact form and request a call.

Can refurbished tech be trusted?

Yes, all devices go through a 60-point diagnostic test including battery assessment, have been refurbished to strict government standards and come with a 1 year warranty.

Is the benefit available all year round?

Yes, this is offered as an anytime benefit so employees can access the benefit multiple times per year if required up to any limit set.

How much can employees save?

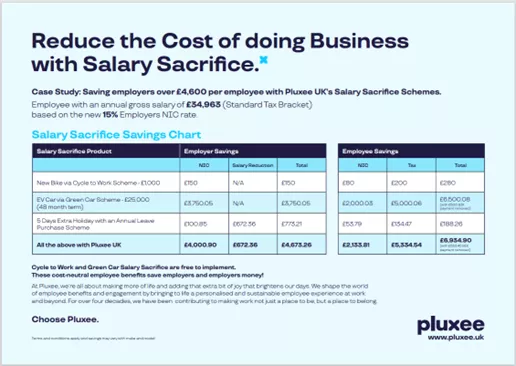

In lieu of a calculator (which we can build) we have this chart. Green Car calculators are highly complex. We have calculators we can replicate on our customer sites for C2W and SmartPay.

Can employees order more than one device?

Yes, they can order multiple devices up to the order value limit set by the employer.

Can a limit be set per employee?

Yes, employers choose the spend limit per employee as part of the set up.

How long is the benefit term?

Typically, the benefit is offered over a 12 month period.

Are your employee discounts available all year round?

Yes! Our discounts are consistent. Retailer relationships may change over time, but once on the platform, discounts are available all year round. We also run ad hoc promotions where the savings are even bigger for a specific period.

Does your employee benefits platform link to Facebook, Yammer or other social media platforms?

We haven't designed our employee benefits platform to link with social media platforms.

Can Pluxee UK provide us with information on Private Medical or Life Insurance?

We do not provide Private Medical or Life Insurance as part of our client employee benefits offering. However, we have trusted partners in those areas and will happily point you in the right direction.

Say we embed your employee benefits platform into our business but also have contracts with other providers. If those contracts are for products Pluxee UK also offers, do we have to switch from our existing supplier to you?

Not at all. We understand you may be happy with your other provider and may be locked into a contract, and we do not require you to switch to us. You may find a centralised solution is more effective for ease of planning, and when you're ready, we'll happily discuss how we can help.

Can we promote non-Pluxee products on your employee benefits platform?

Yes, you can. We encourage you to make all your employee benefits as accessible as possible, even those we do not provide. Our platform integrates with third-party benefits for a more seamless user experience.

Can I create multiple user groups when using your employee benefits platform?

Yes, you can. You can create multiple microsites and segment different audiences. Microsites or use groups are ideal for businesses that offer different benefits depending on level or grade. Each microsite or user group will only be able to view or access the specific employee benefits you've made available to them.

Can your employee benefits platform be branded?

Absolutely You can make our employee benefits platform unique to your branding.

Does your employee benefits platform integrate with our HR systems?

Unfortunately not. Our employee benefits platform will integrate with other third-party benefits but not with HR operating systems.

Will employees receive any aftercare on the scheme?

We take your employees’ experience seriously with their safety being a top priority. All employees will receive: Unlimited lifetime safety checks on all cycles obtained through the scheme. A Lifetime Guarantee on Halfords Brand Cycles. An optional 14-day free insurance on all bikes. An additional unlimited 10% discount card on cycle essentials ensures savings throughout the year.

What is a letter of collection?

A LOC is exactly what it says. A letter that you can use to collect your chosen bike and/or accessories. This will be sent via email once the application is approved.

How quickly can employees collect their bikes?

We aim for your employees to receive their vouchers ASAP. Therefore, upon your approval, we can guarantee that your employees’ letter of collection will be issued the next working day.

I don’t want employees to deal with hidden charges at the end of hire.

Under our scheme, we can guarantee that employees have an option in place that is totally free of charge and guarantees their savings. Employees are offered the option to purchase the bike immediately for a charge determined by HMRC however 99% of all employees will opt for our zero-cost end-of-hire.

Some bikes cost more that the £1,000 limit.

Through our partnership, you can set a limit that is totally at your discretion. We have found that with the increase in demand particularly on electric bikes employers are eager to set a limit that maximises everyone’s savings. Our average limit tends to be between £2,500-£3,000.